Situation

Our client witnessed the changing behavior of customers and competitors in a digital era.

Customers looked for:

- Easier transactions, namely the ability to manage their assets at their fingertips 24/7;

- Deeper relationships with their banker, shifting from discretionary to advisory mandates. They expected tailor-made investment strategies, online access to bespoke investment ideas, and live portfolio monitoring;

- Performing investment solutions, with transparent fees, as banking secrecy was no longer private bank's core value proposition.

Competitors shaped their strategy leveraging digital technologies:

- Leading retail banks had a mature online offering, and invested in FinTech start-ups to take advantage of innovative technologies;

- Digital banks implemented mobile-first strategies and aggressive pricing.

Approach

Digital is customer-facing. At OWT, we have integrated this fact by basing our methodology on the value chain to guide our Clients' digitalization journey. The starting point is to answer the following question: “Which part of the value chain can I deliver to my customers online?”. To do so, we followed a 4-step approach:

- Strategy definition: We designed the value chain and identified customer pain-points, improvement idea, and current digital initiatives within the private bank. We assessed potential projects and placed them in an actionable 3-year roadmap. Our recommendation was to start with a mobile banking application to address the most pressing customers' needs;

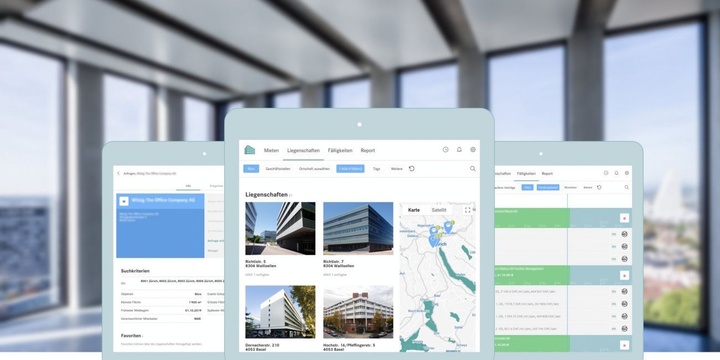

- Blueprint: In this phase, we defined the mobile banking application's features and customer experience, following user-centric design principles;

- Implementation: Not only did we develop the application using agile methodologies and state-of-the-art technologies, but we also set-up an organization centralizing digital expertise. We followed a 3-month development cycle to shorten lead time and continuously improve the application's functionalities;

- Roll-out & support: Digitalization is often unsettling, especially for employees whose role is transformed. In this phase, we helped relationship managers adopt the solution to better interact with their customers. Continuous monitoring of the application usage with analytics provided useful insights to adapt our support and define functionalities of upcoming versions.

The result of this fruitful collaboration between the private bank and OWT is threefold:

- A 3-year roadmap of achievable projects, starting with the launch of a mobile application;

- An organization to deliver digital projects, combining IT and business profiles;

- A governance to orchestrate the bank's digital offering